All Categories

Featured

Table of Contents

Selecting to spend in the property market, stocks, or other basic types of assets is sensible. When deciding whether you need to purchase certified financier chances, you ought to balance the trade-off you make in between higher-reward potential with the absence of coverage requirements or regulative transparency. It must be claimed that personal placements entail greater levels of risk and can rather typically represent illiquid investments.

Specifically, nothing below needs to be interpreted to state or suggest that previous outcomes are an indicator of future efficiency neither need to it be analyzed that FINRA, the SEC or any kind of various other safety and securities regulatory authority authorizes of any of these securities. Additionally, when assessing private positionings from enrollers or companies supplying them to approved financiers, they can give no guarantees expressed or suggested as to precision, efficiency, or results obtained from any details supplied in their discussions or discussions.

:max_bytes(150000):strip_icc()/accreditedinvestor_final-f821797e377f4f5aaf1310f1f47d181d.jpg)

The firm needs to offer details to you with a record called the Private Placement Memorandum (PPM) that uses a much more comprehensive explanation of expenditures and dangers related to taking part in the investment. Passions in these bargains are just offered to individuals that qualify as Accredited Investors under the Securities Act, and a as specified in Section 2(a)( 51 )(A) under the Business Act or an eligible staff member of the monitoring firm.

There will not be any type of public market for the Interests.

Back in the 1990s and very early 2000s, hedge funds were known for their market-beating efficiencies. Normally, the manager of an investment fund will establish aside a section of their available properties for a hedged wager.

How much do Accredited Investor Real Estate Crowdfunding options typically cost?

As an example, a fund manager for a cyclical industry might commit a section of the possessions to supplies in a non-cyclical industry to balance out the losses in situation the economy containers. Some hedge fund managers utilize riskier strategies like using borrowed money to acquire even more of an asset merely to multiply their prospective returns.

Similar to mutual funds, hedge funds are expertly managed by job investors. However, unlike shared funds, hedge funds are not as purely controlled by the SEC. This is why they are subject to less analysis. Hedge funds can relate to different investments like shorts, alternatives, and derivatives. They can likewise make alternative financial investments.

What does Exclusive Real Estate Crowdfunding Platforms For Accredited Investors entail?

You might choose one whose investment viewpoint lines up with yours. Do maintain in mind that these hedge fund cash managers do not come inexpensive. Hedge funds normally bill a fee of 1% to 2% of the properties, in enhancement to 20% of the profits which functions as a "performance fee".

You can buy an asset and obtain compensated for holding onto it. Certified financiers have a lot more opportunities than retail financiers with high-yield investments and beyond.

Who offers the best Accredited Investor Commercial Real Estate Deals opportunities?

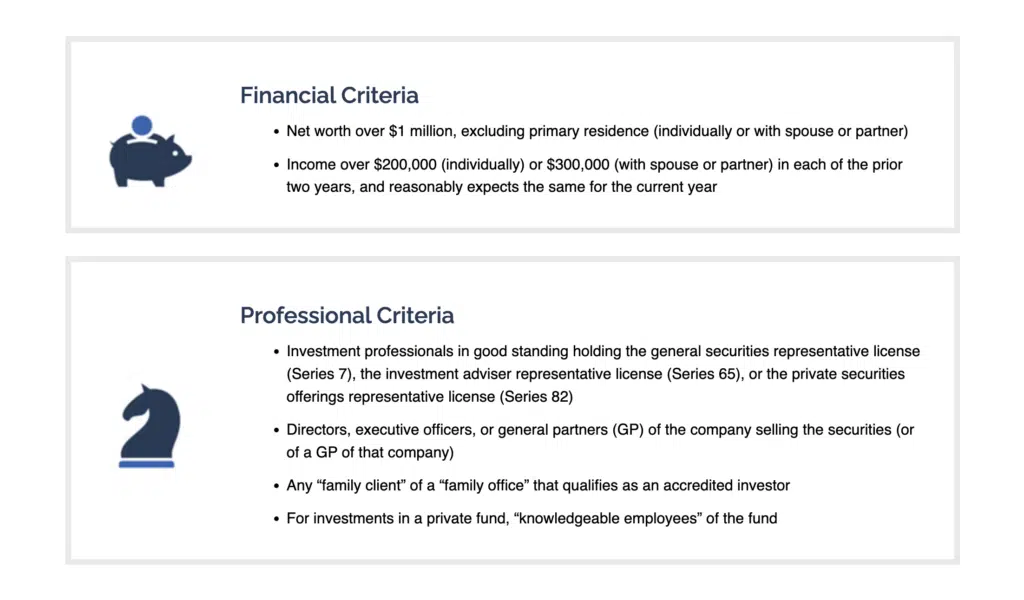

You must meet a minimum of one of the following parameters to become a certified capitalist: You should have more than $1 million total assets, omitting your primary house. Organization entities count as accredited financiers if they have more than $5 million in possessions under administration. You should have a yearly revenue that exceeds $200,000/ yr ($300,000/ year for companions filing with each other) You need to be an authorized investment expert or broker.

As an outcome, approved financiers have a lot more experience and cash to spread out across possessions. The majority of investors underperform the market, including accredited investors.

In enhancement, investors can construct equity through positive cash flow and home appreciation. Real estate residential properties require substantial upkeep, and a great deal can go incorrect if you do not have the appropriate group.

Is Commercial Real Estate For Accredited Investors worth it for accredited investors?

Real estate distributes merge cash from certified investors to acquire residential or commercial properties lined up with well established goals. Recognized investors pool their cash with each other to finance acquisitions and property development.

Actual estate investment trust funds have to disperse 90% of their taxed revenue to investors as returns. REITs allow investors to branch out quickly throughout several residential property classes with really little funding.

Passive Real Estate Income For Accredited Investors

The owner can determine to apply the convertible option or to sell prior to the conversion takes place. Convertible bonds allow investors to acquire bonds that can end up being stocks in the future. Investors will certainly profit if the stock price rises since exchangeable investments provide a lot more attractive entrance points. Nonetheless, if the stock topples, financiers can choose against the conversion and safeguard their funds.

Latest Posts

How To Buy Homes That Owe Back Taxes

Properties With Tax Liens Near Me

Tax Foreclosures List