All Categories

Featured

Table of Contents

RealtyMogul's minimum is $1,000. The remainder of their business property bargains are for accredited investors only. Right here is a thorough RealtyMogul introduction. If you desire more comprehensive real estate direct exposure, after that you can consider acquiring an openly traded REIT. VNQ by Lead is one of the biggest and popular REITs.

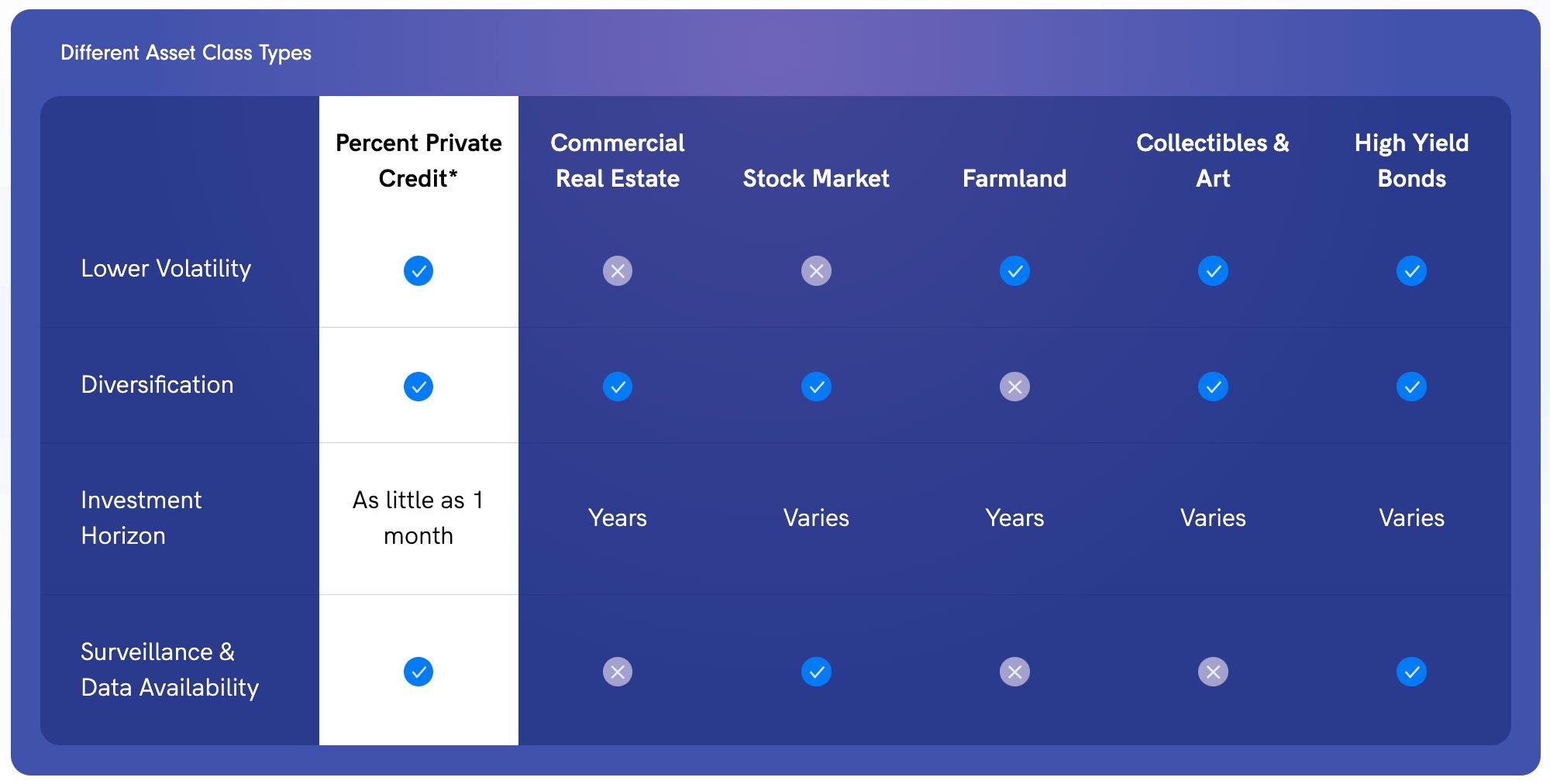

Their number one holding is the Lead Real Estate II Index Fund, which is itself a mutual fund that holds a selection of REITs. There are other REITs like O and OHI which I am a long-time investor of. REITs are a very easy means to acquire realty exposure, however it doesn't have the exact same amount of emphasis as eREITs and private commercial realty bargains.

To be an accredited financier, you should have $200,000 in annual income ($300,000 for joint investors) for the last 2 years with the expectation that you'll earn the very same or more this year. You can likewise be thought about a recognized investor if you have a total assets over $1,000,000, independently or jointly, excluding their main home.

Who provides reliable Real Estate Investment Partnerships For Accredited Investors options?

These offers are usually called private positionings and they do not need to sign up with the SEC, so they do not provide as much information as you would certainly anticipate from, say, a publicly traded firm. The recognized capitalist requirement thinks that someone that is approved can do the due diligence on their own.

You simply self-accredit based on your word., making it much easier for more people to qualify. I believe there will certainly be proceeded movement away from high price of living cities to the heartland cities due to cost and technology.

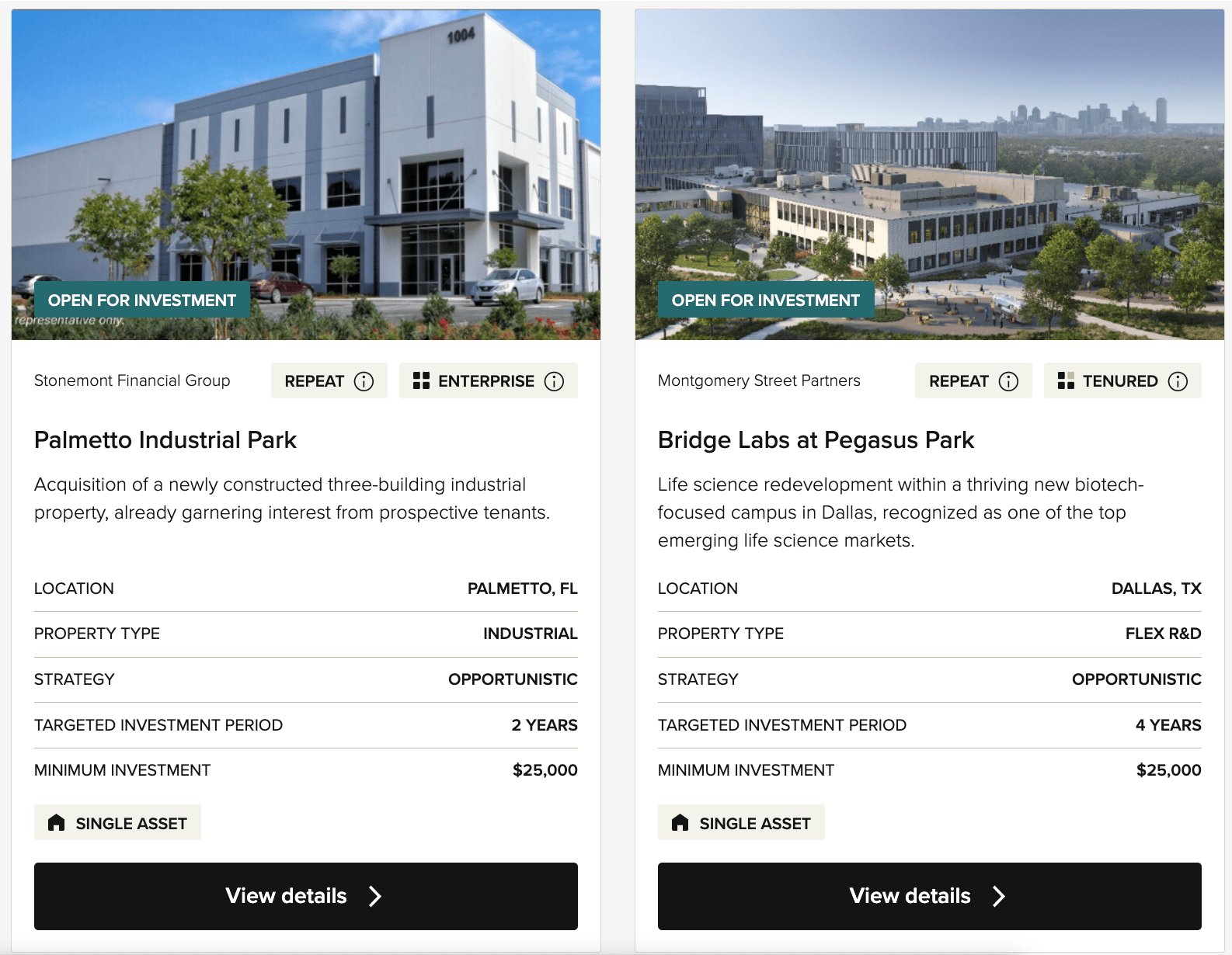

It's everything about following the cash. In enhancement to Fundrise, additionally look into CrowdStreet if you are a recognized investor. CrowdStreet is my preferred system for recognized financiers since they concentrate on arising 18-hour cities with reduced evaluations and faster population growth. Both are totally free to register and explore.

Below is my property crowdfunding control panel. If you wish to discover more about realty crowdfunding, you can visit my realty crowdfunding learning facility. Sam operated in investing banking for 13 years. He received his undergraduate degree in Business economics from The University of William & Mary and got his MBA from UC Berkeley.

He hangs around playing tennis and taking care of his family members. Financial Samurai was begun in 2009 and is among the most trusted individual finance sites online with over 1.5 million pageviews a month.

Key Takeaways What are taken into consideration the very best realty investments? With the united state realty market rising, financiers are looking through every available residential property type to uncover which will certainly assist them earnings. So which industries and buildings are the very best steps for capitalists today? Keep checking out to find out more about the finest kind of realty financial investment for you.

What is the process for investing in High-return Real Estate Deals For Accredited Investors?

Each of these types will certainly come with special advantages and disadvantages that financiers ought to review. Allow's consider each of the options offered: Residential Realty Commercial Real Estate Raw Land & New Building Realty Investment Company (REITs) Crowdfunding Systems Register to participate in a FREE on-line realty class and find out exactly how to start purchasing property.

Various other properties include duplexes, multifamily buildings, and villa. Residential property is suitable for numerous investors due to the fact that it can be simpler to turn earnings continually. Certainly, there are several residential actual estate investing techniques to deploy and various levels of competition throughout markets what may be right for one financier might not be best for the next.

Accredited Investor Property Portfolios

The ideal business buildings to buy include commercial, office, retail, friendliness, and multifamily jobs. For investors with a strong emphasis on enhancing their local neighborhoods, commercial property investing can support that focus (Accredited Investor Rental Property Investments). One factor commercial residential properties are taken into consideration one of the most effective kinds of realty investments is the possibility for higher capital

To find out more concerning obtaining started in , be certain to read this short article. Raw land investing and new building stand for two sorts of realty investments that can expand a capitalist's portfolio. Raw land refers to any kind of vacant land offered for purchase and is most eye-catching in markets with high predicted growth.

Buying new building and construction is additionally preferred in quickly growing markets. While many capitalists may be not familiar with raw land and new construction investing, these financial investment types can represent attractive revenues for financiers. Whether you are interested in developing a residential property from beginning to finish or benefiting from a lasting buy and hold, raw land and new construction offer an one-of-a-kind opportunity to investor.

What is included in Commercial Real Estate For Accredited Investors coverage?

This will certainly ensure you select a desirable location and avoid the financial investment from being hampered by market factors. Realty investment company or REITs are business that have different commercial realty kinds, such as hotels, shops, workplaces, malls, or dining establishments. You can invest in shares of these property companies on the stock exchange.

This supplies capitalists to get returns while diversifying their profile at the very same time. Openly traded REITs additionally supply adaptable liquidity in contrast to various other types of real estate investments.

While this provides the ease of finding possessions to capitalists, this type of actual estate financial investment likewise presents a high amount of threat. Crowdfunding platforms are usually limited to approved investors or those with a high net well worth.

Who offers the best Private Real Estate Investments For Accredited Investors opportunities?

[Discovering how to buy realty does not have to be difficult! Our online property spending class has everything you require to shorten the understanding curve and begin purchasing property in your area.] The most effective sort of property investment will depend on your private circumstances, objectives, market area, and preferred investing method.

Choosing the best residential property type comes down to weighing each choice's pros and disadvantages, though there are a couple of essential elements investors must keep in mind as they look for the very best selection. When selecting the most effective kind of investment residential or commercial property, the relevance of location can not be downplayed. Investors running in "up-and-coming" markets might find success with uninhabited land or brand-new building and construction, while capitalists operating in more "mature" markets might want property properties.

Evaluate your favored degree of involvement, threat tolerance, and profitability as you make a decision which residential or commercial property kind to purchase. Investors wanting to tackle an extra passive function might go with buy and hold business or houses and employ a property manager. Those hoping to tackle a much more energetic duty, on the various other hand, might discover establishing uninhabited land or rehabbing household homes to be more satisfying.

Latest Posts

How To Buy Homes That Owe Back Taxes

Properties With Tax Liens Near Me

Tax Foreclosures List